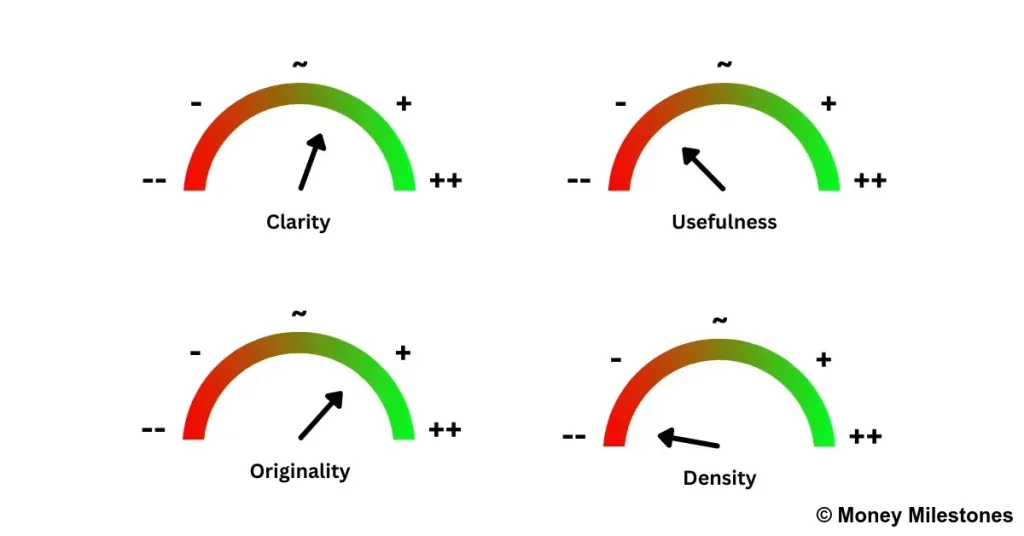

Die with Zero by Bill Perkins: An honest review

Die with Zero is a lifestyle self-help book by Bill Perkins, a successful American trader. He argues that we should all aim to use up our savings and investments by the time we die. But does his approach actually make sense? And will it help you make better decisions about money and life? That’s what we’ll explore in this review.

A new take on money and life planning

Die with Zero stands out because it takes a very different approach from most money management books. Usually, the advice is to save as much as possible in your early and mid-years. That way, you can enjoy a relaxing retirement: sunbathing on the beach, travelling the world, and ticking off your bucket list.

This book flips that script. Its core message is simple: work less, enjoy life more, and spend your money earlier. Waiting too long means missing out. As Bill Perkins puts it:

It makes no sense to let opportunities pass by for fear of squandering our money. Squandering our lives should be a much greater worry.

Key ideas from Die with Zero

Here are the main ideas that Bill Perkins shares in Die with Zero. Just to be clear: I don’t agree with all of them.

- Experiences are more valuable than money. Having more life experiences makes you more fulfilled and more interesting.

- Dying with savings is a waste. If you die with assets, you’ve worked for free. You should have used that money to live more fully.

- Be intentional with your time and money. Avoid going through life on autopilot. Use your money to create the experiences you actually want.

- Don’t wait until retirement. You likely won’t be able to spend all your money later, and your body will be too tired to enjoy it. The most useful years for money are between 45 and 65.

- Plan your retirement spending. Use tools like annuities to avoid running out of money. Perkins argues that expenses, including medical ones, often go down as we age.

- Invest in your health early. Don’t save everything for end-of-life care. Live well now rather than spending loads just to extend life by a few weeks later.

- Give earlier. Giving to children or charity is more impactful while you’re alive than after you’re gone.

- Take more risks when you’re young. You’ve got time to recover if things go wrong.

- Don’t delay time-sensitive experiences. Most experiences, like seeing your children grow up, have a window that closes forever.

- Use time buckets. Plan your life by splitting it into phases. Think about what experiences you want to have in each.

Some of the points in Die with Zero are original and valid. Perkins challenges common assumptions about saving, spending, and enjoying life. However, I still don’t recommend reading the book unless you fit a very specific profile. We’ll look at why in the next section.

What Die with Zero gets right

By all accounts, Die with Zero is an interesting read. Surprisingly, I found that the most thought-provoking ideas are only loosely related to money, or not related at all.

One strong example is Bill Perkins’ perspective on health. He encourages acting early instead of saving for expensive, late-life fixes. Another is his reminder not to live on autopilot. Instead, we should make conscious, deliberate decisions about how we use our time and money.

Another is his unusual but well-argued take on inheritance. He challenges the traditional idea of leaving money behind at death. In his words:

If you wait until you die to have your children inherit your money, you’re leaving the outcome to chance. I call it the three Rs – giving random amounts of money at a random time to random people (because who knows which of your heirs will still be alive by the time you die?)

Where Die with Zero falls short: Too repetitive

That’s it for the positives. Now, let’s talk about the downsides.

First of all, this book is far too long. Many of its points are repeated again and again, often using the same metaphors and examples. Seriously, the entire message could be condensed into 10 to 20 pages. My summary above captures about 90% of the book’s wisdom.

By the final chapters, I found reading it almost painful. Just to give you one example: The Ant and the Grasshopper is used as a metaphor five times though-out the book, sometimes stretched over several pages.

Can you really measure life? Why Perkins’ points system doesn’t work

Another aspect of the book that I find dubious is Perkins’ attempt to persuade the reader that it’s possible to quantify the value of everything. Climbing Everest? That’s 100 points! Having kids? 500! Owning a big house? Let’s say 150.

Now, to be fair, Perkins doesn’t assign those values himself. But he tells the reader that:

- All life experiences have a quantifiable value,

- Everyone should go through the process of quantifying them, and

- They should then try to optimise their choices to maximise the number of “experience points” they collect in life.

I think this idea is extremely naive, and frankly, not very useful if you’re trying to live better. Even if we assume every life experience can somehow be boiled down to a single number (which, again, seems absurd), what happens next? How do we find out what the number is? How do we decide which experiences are worth rating among the infinite ones we could have?

And what about the things we never planned, but ended up enjoying? I could go on. I don’t think this approach makes sense. And to be clear: I’m all for quantifying things that are actually quantifiable. But life experiences aren’t one of them.

Why Die with Zero can be dangerous

Now, here’s a much bigger issue. In my opinion, Die with Zero is a dangerous book for most people.

The entire premise of Perkins’ argument assumes that you’re either asset-rich and old, or young and highly paid. He also assumes you’re working too much, saving too much, and not enjoying life enough. There are definitely people like that. And for them, this book might be perfect.

But if you’re a regular person, earning a normal salary and struggling to save each month, the advice in this book could lead you into serious trouble.

Everyone wants to hear that they should stop saving and spend more on memorable experiences. Everyone wants to work less and spend more time with family. But is that reasonable? Is it realistic? If you’re a multimillionaire trader like Bill Perkins, then maybe yes. But if you’re the average person, probably not. Unless you want to end up bankrupt.

A book for the lucky few

My biggest issue with this book is Bill Perkins’ complete lack of self-awareness. He doesn’t seem to realise that his life experience is radically different from that of most people, and that his advice often doesn’t apply to them. To his credit, he does have the occasional flash of clarity:

The indigent just don’t have the luxury of trying to find the optimal balance between work and play, or between spending now and investing in the future.

The problem is, this doesn’t just apply to the indigent. It applies to at least 95% of the population. It genuinely baffles me that this seems to have escaped Perkins, especially since, as he explains in the book, he comes from a humble background.

Final thoughts: Should you read Die with Zero?

In a nutshell, Die with Zero is for you if you’re an overworked multimillionaire who hasn’t yet realised that life isn’t just about money.

Otherwise, your time is better spent on books like The Psychology of Money, for example, which I’ve reviewed recently.

Still curious? You can find Die with Zero here.

If you enjoyed this article, check out some of my other pieces on Money Milestones, like how to negotiate a pay rise or how to retire early (even if you’re not a multimillionaire trader!). Thanks again for reading!