Opting out of your workplace pension: smart move or costly mistake?

If you work in the UK, are between 22 and 66 years old, and earn at least £10,000 per year, your employer is required to automatically enrol you in a workplace pension. Even if you don’t meet all these criteria, you may still be able to join voluntarily. But what if you’re thinking about opting out of workplace pension schemes altogether? Is it the right decision for you?

What is a workplace pension and how does it work?

A workplace pension is a way to save for retirement in addition to the State Pension provided by the government. Typically, you contribute a small portion of your salary each month. This goes toward an extra retirement income, either guaranteed or dependent on investment performance (as explained below). You can only access these funds after a certain age, currently 55, but rising to 57 in 2028.

What types of workplace pensions are there in the UK?

There are two main types of workplace pensions in the UK.

Defined Benefit (DB) pensions

A defined benefit pension guarantees you a set income in retirement, based either on your final salary or your career average salary. This type of pension is highly valued for its security, as the payout does not depend on investment performance.

However, it has become increasingly rare in the private sector due to the high costs for employers. In contrast, it remains the standard in the public sector, covering workers such as NHS staff, civil servants, and firefighters.

Defined Contribution (DC) pensions

In this case, your workplace pension is a long-term investment aimed at building sufficient funds for retirement.

Unlike a Defined Benefit Pension, your retirement income is not guaranteed. Instead, your funds are invested, meaning their value can rise or fall. Typically, contributions are made to your pension each month through salary sacrifice (which reduces your take-home pay), with your employer adding extra funds on top. The government also often contributes through tax relief on your contributions.

How to tell if you have a Defined Benefit pension

Each year, your workplace pension provider should send you a pension statement. This could come by post, email, or through an online platform. This statement will include key details about your pension, allowing you to determine whether you have a Defined Benefit pension or a Defined Contribution pension.

If you have a Defined Benefit pension, your statement will almost certainly include details such as your years of service and your current or average salary. It will also show your expected retirement income and benefits. However, be aware that Defined Contribution pensions may also include retirement income projections, so don’t assume you have a DB pension based on this alone.

How to tell if you have a Defined Contribution pension

If you have a Defined Contribution pension, your statement should include details such as the current value of your pension pot and your contributions, including how much you and your employer have added. It should also show your investment performance, indicating whether your pension has grown or declined. As explained above, retirement income projections may also be included. However, these are estimates based on assumptions about future investment growth.

If you’re unsure about your pension type, your employer or HR department should be able to clarify this for you.

Is the State Pension enough to live on in retirement?

The full State Pension is currently £230 per week (as of 2025/26). However, you may not receive this full amount, as the actual sum depends on factors like how many years of National Insurance (NI) contributions you’ve made, along with other considerations.

The exact amount you would receive from the State Pension is quite complex to work out, but one thing is certain: it’s not much. Unless you own your home, have no dependants, don’t rely on a car, and grow your own food (you get the idea), it’s highly unlikely that you’ll be able to live comfortably on just the State Pension.

This is where workplace pensions come in: they exist to supplement the State Pension and help ensure you have enough to live on in retirement.

At this point, you might be thinking: “Okay, I get it, I need to set some money aside because I can’t survive on just the State Pension. But wouldn’t I be better off opting out of my Workplace Pension and investing the money myself?”

Well, that’s a very good question, and we’ll see next why this is usually a terrible idea.

Why opting out of a Defined Benefit pension is almost always a bad idea

First of all, if you have a Defined Benefit (DB) Pension, these are generally very advantageous from a financial standpoint. As mentioned earlier, they offer a high level of security and certainty about your retirement income.

It’s extremely unlikely that you’ll be better off if you opt out of a DB pension and invest your monthly contributions elsewhere. I’m not saying it’s impossible (the specifics of your pension scheme can make a difference) but for the vast majority of people with a DB pension, opting out is a terrible decision. Let’s see why, with an example.

Opting out of a DB pension: what you’d be giving up

Jamie is an NHS worker earning an annual salary of £30,000. To participate in the NHS Pension Scheme, he must sacrifice 8.3% of his salary: that’s £2,490 per year. After one year, he secures the right to receive 1/54th of his annual salary as a yearly retirement income, which comes to about £556. This is a guaranteed income that he will receive every year in retirement.

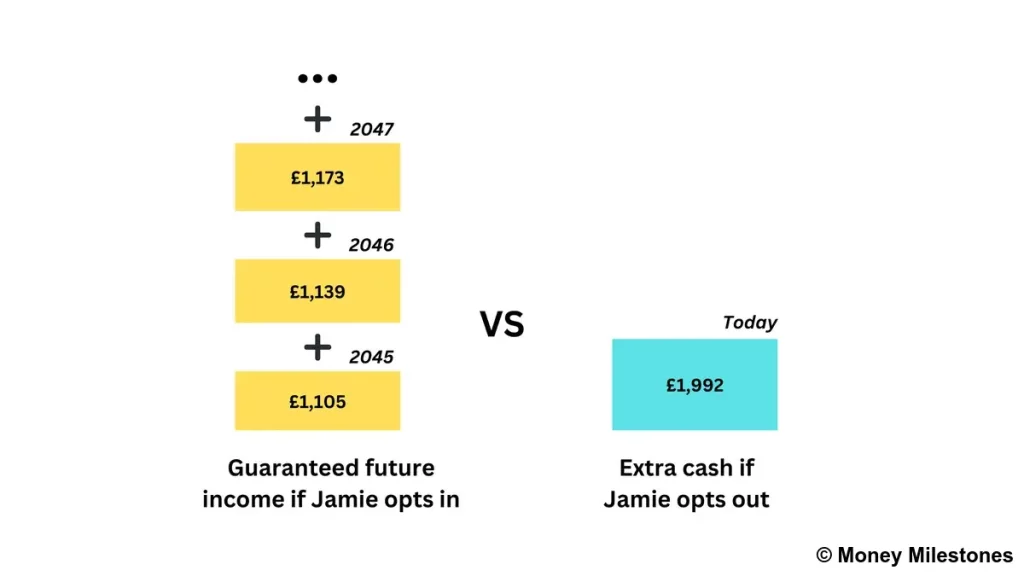

But there’s more. These £556 aren’t fixed; they are revalued each year. While the exact rate of revaluation can vary, if we use the NHS’s suggested rate of 3.5% and assume Jamie retires in 20 years, that initial £556 grows to approximately £1,105 per year. And once Jamie retires, his pension income is protected against inflation. For example, assuming an inflation rate of 3%, his pension would start at £1,105 in the first year, then rise to about £1,139 in the second year, £1,173 in the third, and so on.

A guaranteed income for life vs. a small pay rise today

If Jamie were to opt out of the NHS Pension Scheme, he’d be giving up a guaranteed, inflation‐protected income. In return, he’d get an extra £2,490 per year in salary. However, once tax is considered (at a 20% rate), that extra cash comes to roughly £1,992 in take-home pay. If I were in Jamie’s shoes, I wouldn’t trade a future, guaranteed yearly income starting at £1,105, and increasing each year, for just £1,992 today.

This example illustrates why, for most people, opting out of a Defined Benefit pension like the NHS scheme is almost certainly a bad idea.

Why opting out of a Defined Contribution pension usually doesn’t make sense

For most employees with a Defined Contribution Pension, opting out of their workplace pension is typically a poor decision for several reasons.

You’d be turning down free money from your employer

By law, your employer must pay at least an extra 3% of your qualifying earnings into your pension pot (provided you contribute at least 5% yourself). If you opt out of your Defined Contribution Pension, you lose this employer contribution. Essentially, you’re saying no to free money from your employer.

And you’d miss out on tax relief too

Furthermore, if you pay income tax (which is almost everyone with a workplace pension), you receive tax relief on your contributions. In practice, this means the government is effectively contributing to your pension pot every time you top it up. Opting out means you’re again saying no to free money, this time from the government.

Why opting out can cost you: a real-world example

Let’s illustrate this with an example. Imagine you earn £35,000, and your workplace pension is set to the absolute bare minimum, with a 3% employer contribution and a 5% employee contribution. It is worth noting that these percentages apply only to qualifying earnings (your salary minus the lower earnings limit, which in this case means £28,760).

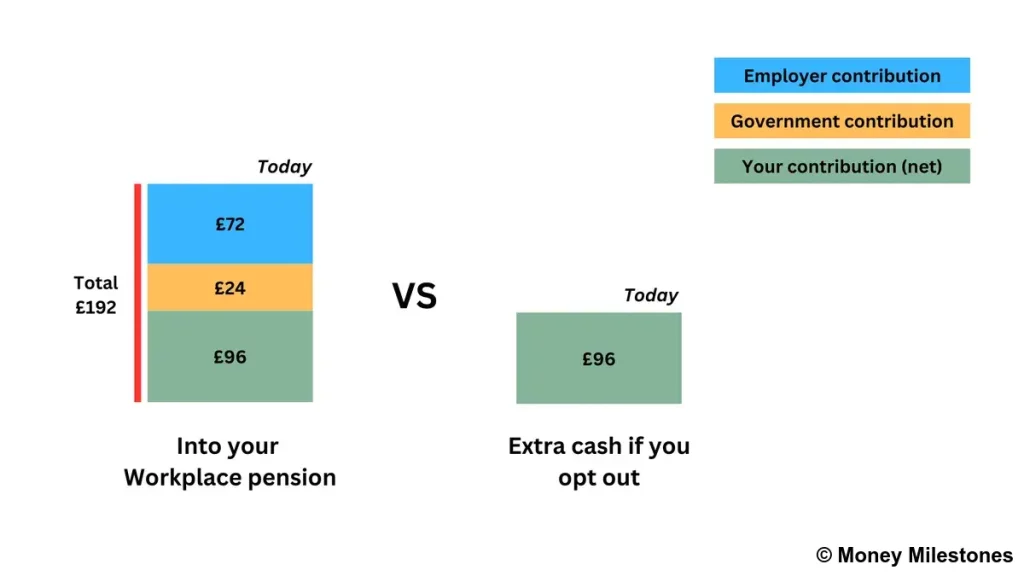

This means you put in £120 each month, and your employer adds another £72. Now, let’s say you opt out. You don’t just lose your employer’s £72, you also lose out on tax relief. Instead of contributing £120 tax-free, that money gets taxed at 20%. This leaves you with just £96 in your pocket. So in total, you’d be swapping £192 in your pension pot for just £96 in cash. You’d need to be an exceptional investor to make that trade-off worthwhile!

And remember, this is actually one of the best-case scenarios for opting out. Many employees have workplace pensions with far more generous employer contributions, sometimes even matching or exceeding what the employee puts in.

The higher your salary, the bigger the pension benefits

And if you earn above £50,270, your income tax rate jumps to 40%, meaning the tax relief on your contributions becomes even more valuable. If you’re lucky enough to earn over £125,140, your tax rate rises to 45%, making a workplace pension an even bigger win.

For many employees, this means they end up with two to four times more ‘investable’ money simply by keeping it in their workplace pension. The advantage is so massive that it’s virtually impossible to beat by opting out and investing the money yourself.

When opting out of your workplace pension might make sense

In some very specific situations, opting out of a workplace pension might make sense, at least for a while.

If you’re struggling with debt

If you have significant high-interest debt, such as credit card balances or payday loans, it might make sense to temporarily opt out of your workplace pension to focus on repaying what you owe. Clearing high-interest debt quickly can save you a lot of money in the long run.

However, keep in mind that by doing this, you are giving up valuable employer contributions and tax relief, which means trading a significant amount of future money for a smaller amount today. This should only be considered as a short-term measure, not something to do repeatedly.

If you’re struggling with debt, free and confidential advice is available from the National Debtline.

If you’re about to buy a house (in some cases)

When applying for a mortgage, lenders typically assess your affordability based on gross income, not your take-home pay after deductions like pension contributions. This means that, in most cases, your pension contributions won’t reduce the amount you can borrow.

However, some lenders do take pension contributions into account when calculating affordability. If you’re making high contributions, this could slightly reduce how much you’re eligible to borrow.

That being said, there’s a reason banks set borrowing limits in the first place. If you need to opt out of your workplace pension just to afford your mortgage, should you really be buying that house?

If you have an overseas pension (in some cases)

Some countries offer exceptionally advantageous pension plans. If you’re fortunate enough to have access to one, you might consider opting out of your UK workplace pension to contribute to your overseas pension instead.

However, this is a complex area, as different countries have varying rules and tax implications. It’s essential to consult a pension expert to navigate these complexities effectively.

Some not-so-good reasons to opt out

Some people choose to opt out of their workplace pension for reasons like switching jobs frequently, dissatisfaction with their pension scheme’s performance, or believing they’ve already saved enough for retirement.

However, given the financial incentives we’ve covered (employer contributions, tax relief, and long-term growth), these reasons don’t really hold up. In most cases, opting out of workplace pension schemes is not the wisest move.

Should you really opt out of your workplace pension? Final thoughts

That’s all for today! By now, you should have a solid understanding of workplace pensions, the different types available, and why opting out is usually a bad move (unless you fall into one of the rare exceptions we covered).

If you’d like to get a sense of how your pension contributions or other investments might grow over time, try my savings and investments growth calculator. It’s a quick and easy way to explore your financial future.

If you found this helpful, why not explore my other personal finance articles, like the one on investing in gold or my review of The Psychology of Money? You might just discover your next money milestone!

Important note: The figures in this article have been rounded to the nearest pound for readability. They are based on various assumptions and are intended for illustrative purposes only.